PrestaShop Validate VAT in VIES and set 0% VAT

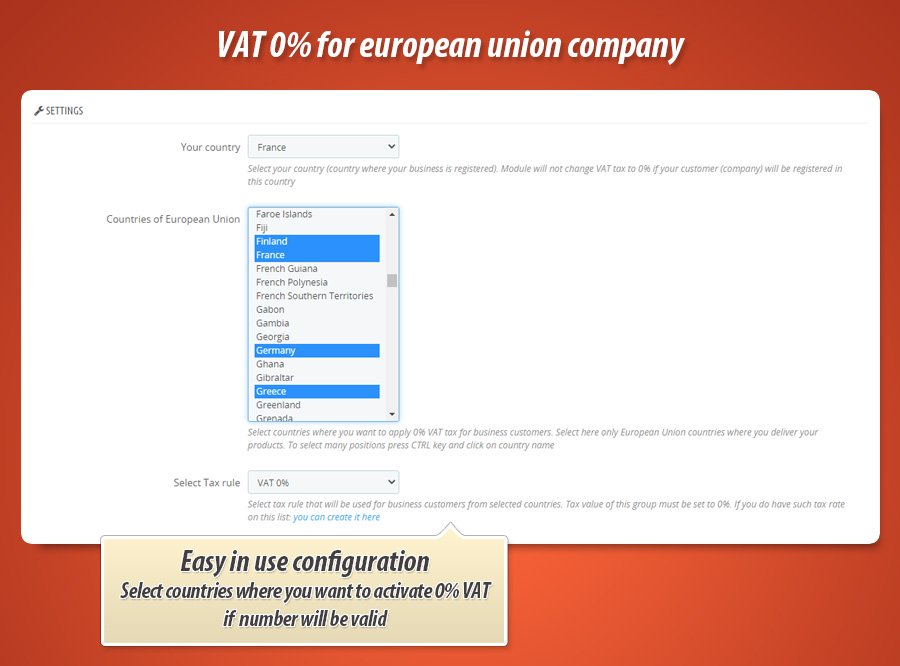

This module gives possibility to validate company VAT number in VIES system. Then - depending on validation result - apply a 0% tax for company that uses this VAT number (if this company register address is in country different than merchant country). Reverse charge VAT will be applicable only for companies with valid VAT numbers.

Galeria

EU VAT Compliance & Automatic Zero-Rate Tax for Businesses

This module automates VAT compliance for EU e-commerce. It validates customer VAT numbers against the VIES database, applying the reverse charge mechanism (0% VAT) for valid B2B transactions. Unregistered users can validate their VAT number via a popup, while logged-in users' billing/invoice address VAT is automatically checked. This ensures accurate tax calculation based on customer location and VAT status, simplifying cross-border sales and adhering to the latest EU VAT regulations. The module streamlines the process, eliminating manual VAT adjustments.

As you already know - this module gives possibility to validate customer's VAT number in VIES service provided by european union. If VAT number will be valid - the company that uses it will be a subject of reverse charge of tax. According to fiscal law, the “reverse charge” process stands for the process of ascribing tax liability to the buyer – to be more specific, the VAT liability. In practice, this means that the buyer settles VAT-related costs directly with the revenue office in country where the company is registered.

VAT tax in european union

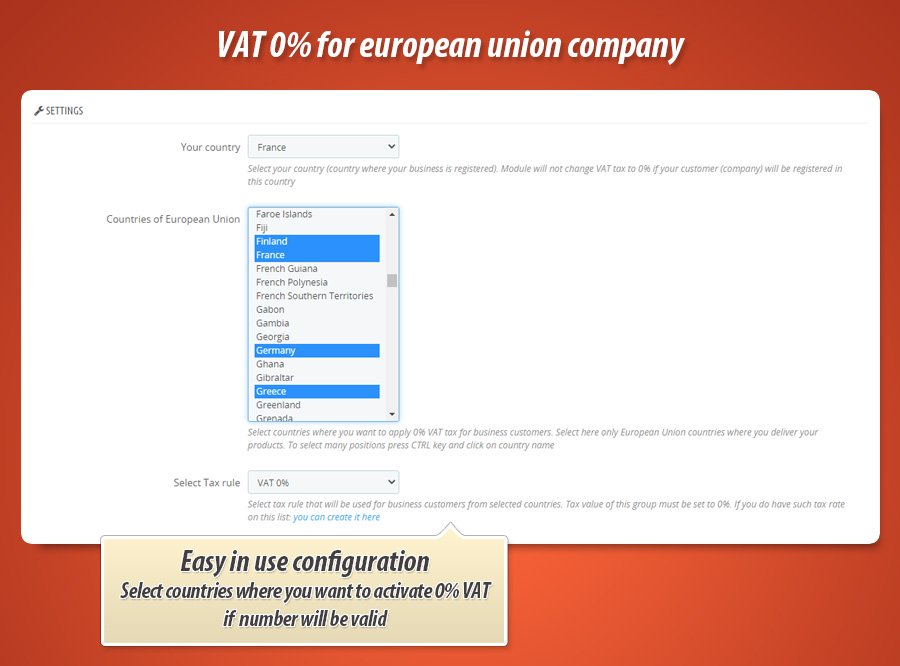

European Union changed VAT tax rules that affects e-commerce business if you're from european union. These VAT rules affects also third-party businesses that operates from third-party countries out of European Union. It is just enough to sell for customers from european union even if you're out of europe. Simply saying - From 1 July 2021 we have new VAT (value added tax) rules on cross-border business-to-consumer (B2C) e-commerce activities in the European Union. These changes requires to sell products with tax rate from country where your customer lives. If your customer will be a business (company from european union) you will need to set vat TAX rate to 0%. And this is the module that will fulfill these needs.

What is the module workflow?

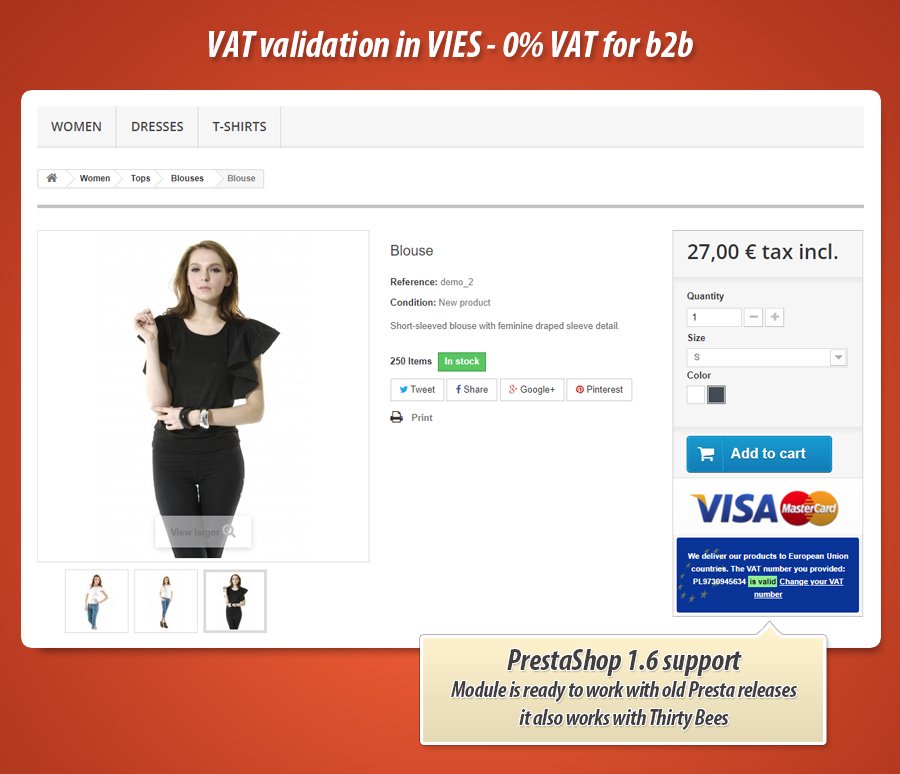

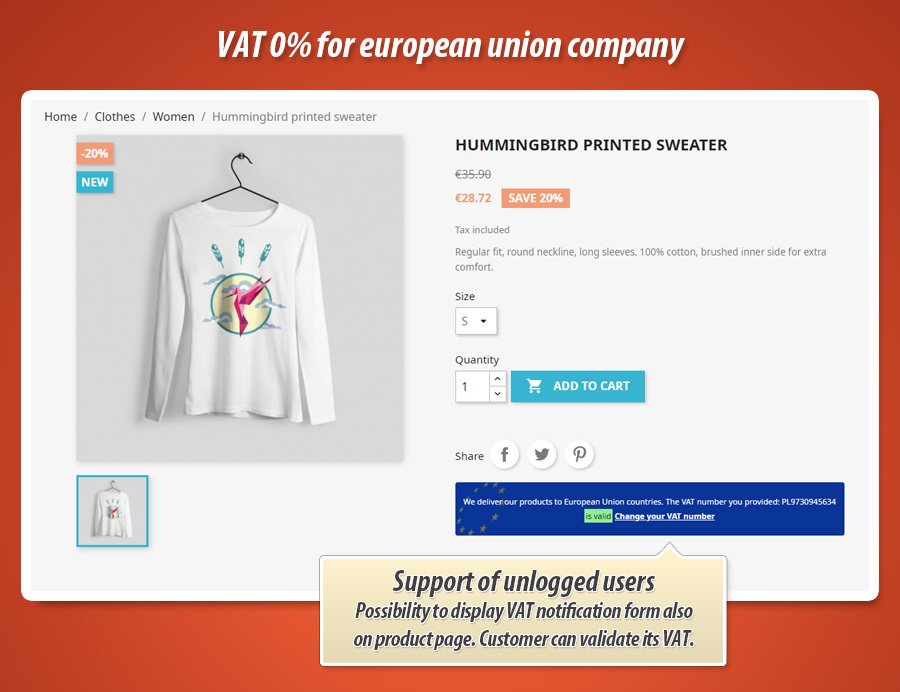

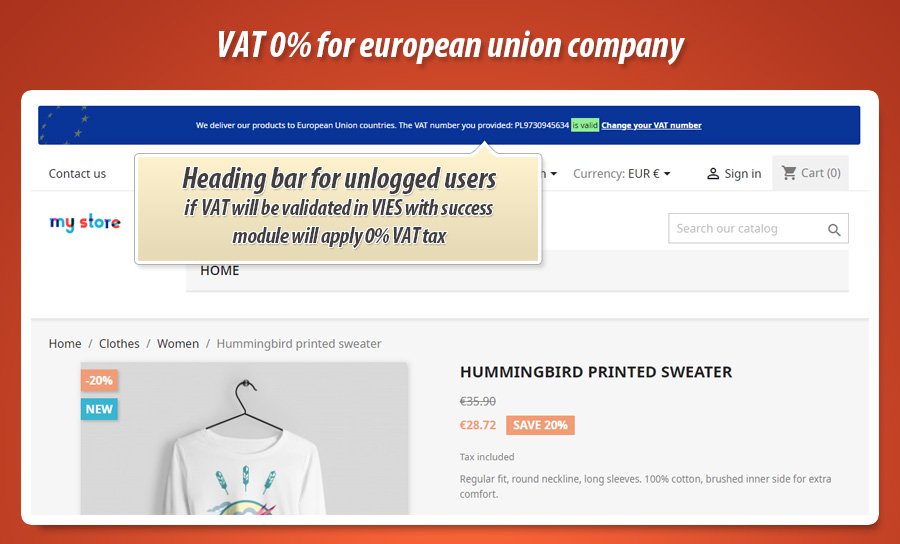

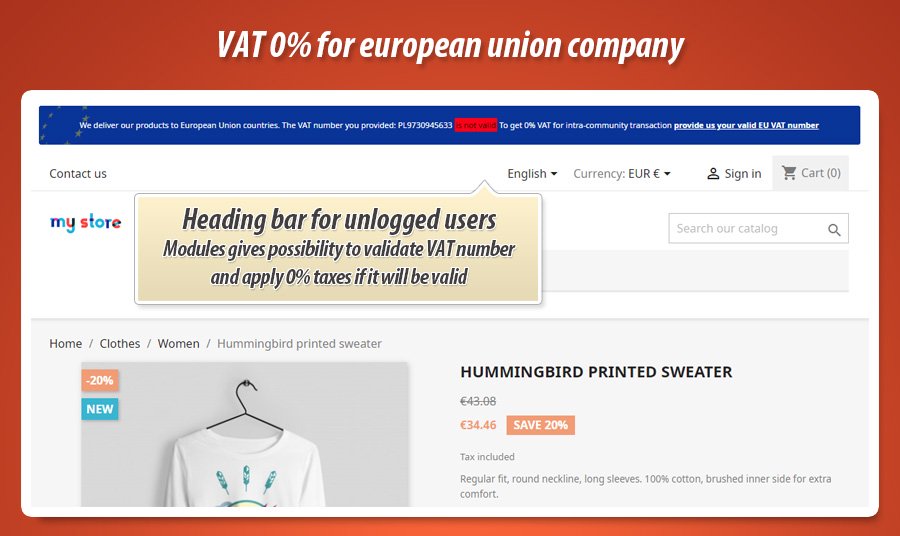

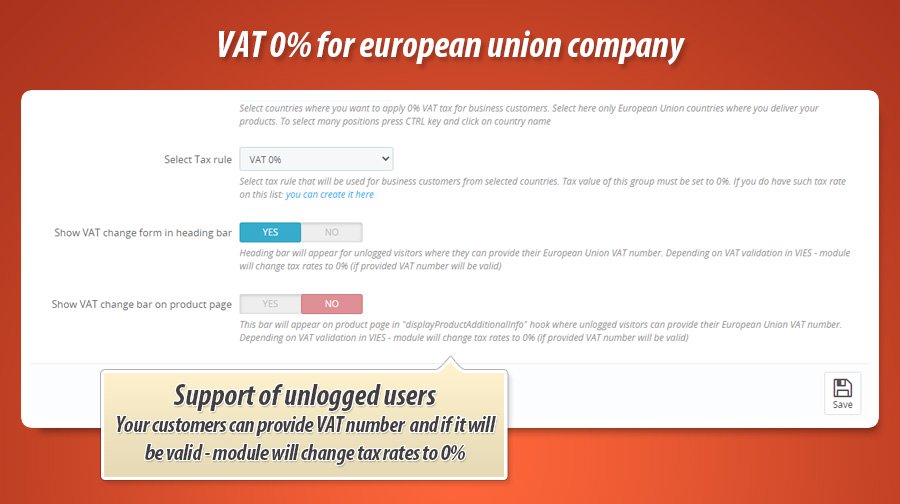

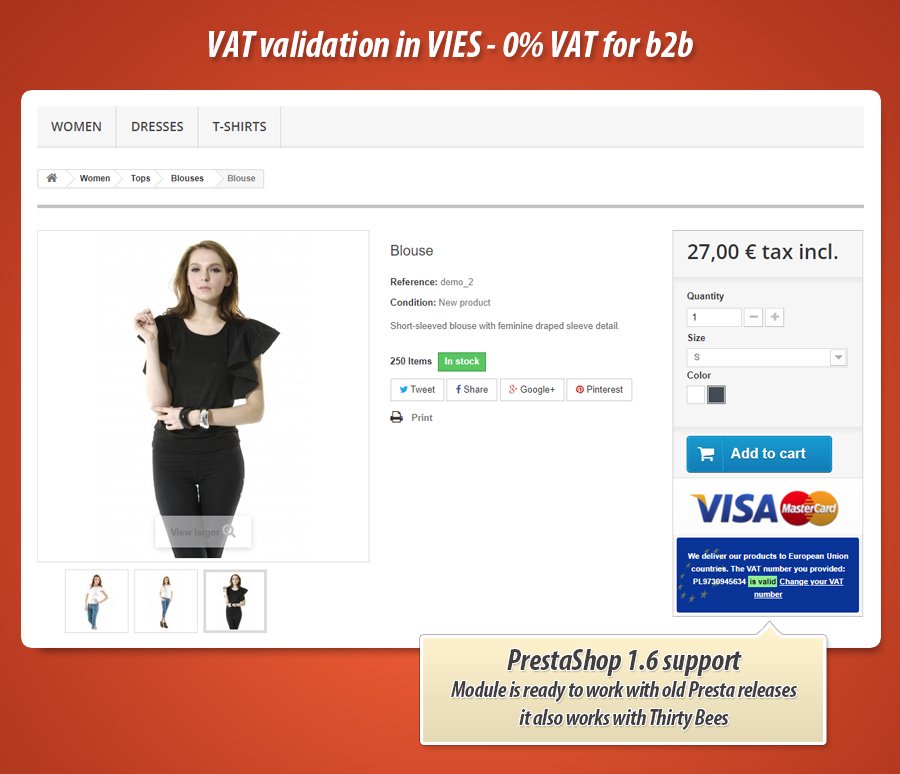

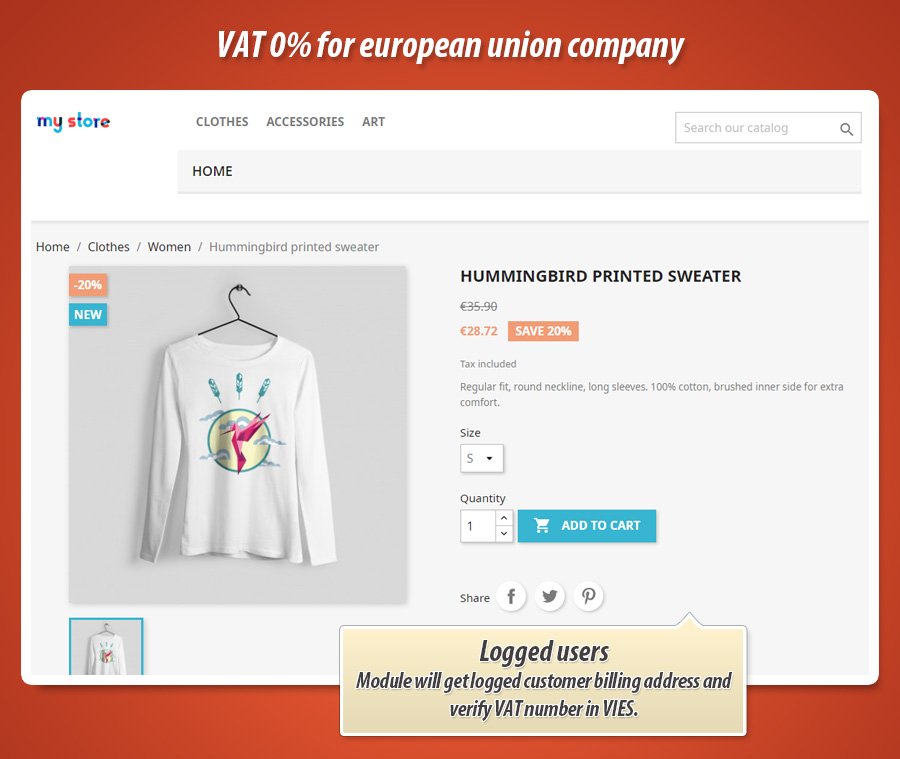

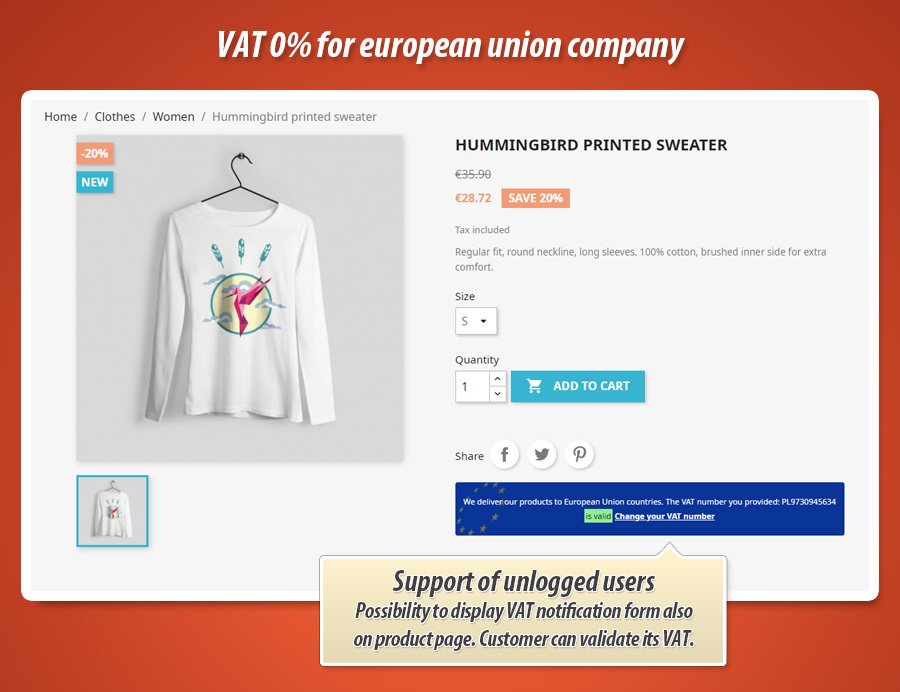

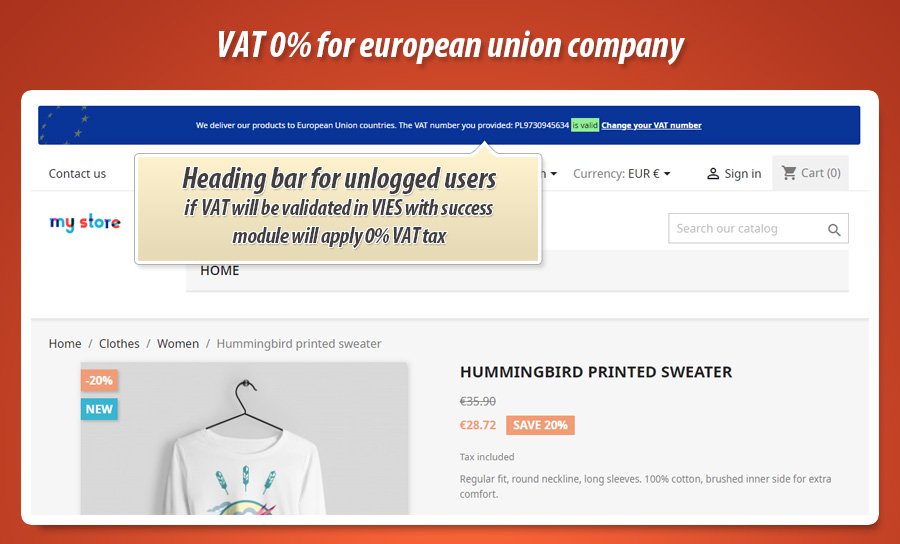

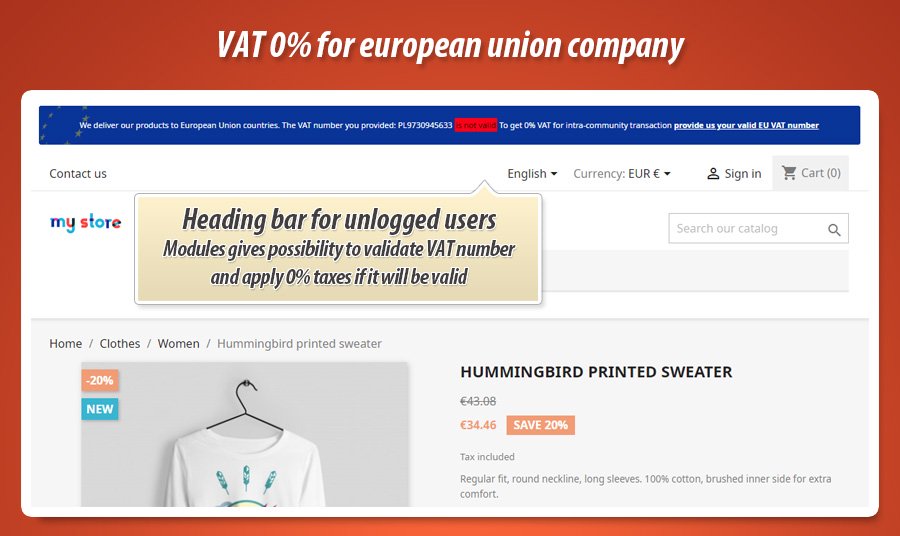

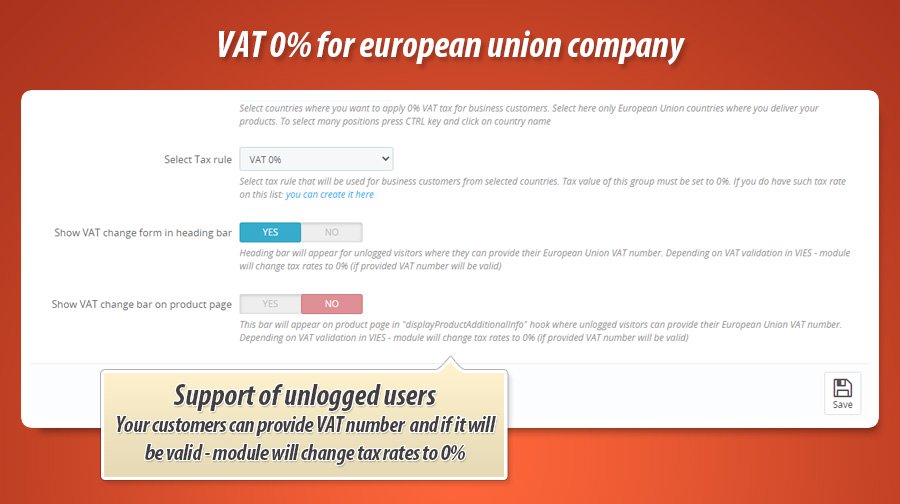

Our addon gives possibillity to validate VAT in two ways. First validation process is available for unlogged users. You can activate heading bar or special bar on product page where customer can click on button to "provide VAT number". This button, once pressed, will spawn popup window with form to validate VAT. After submit - our addon will check if provided VAT number is valid in european union VIES service. If number will be valid - tax rates will be changed to 0% (so customer with this VAT can be a subject of reverse charge tax).

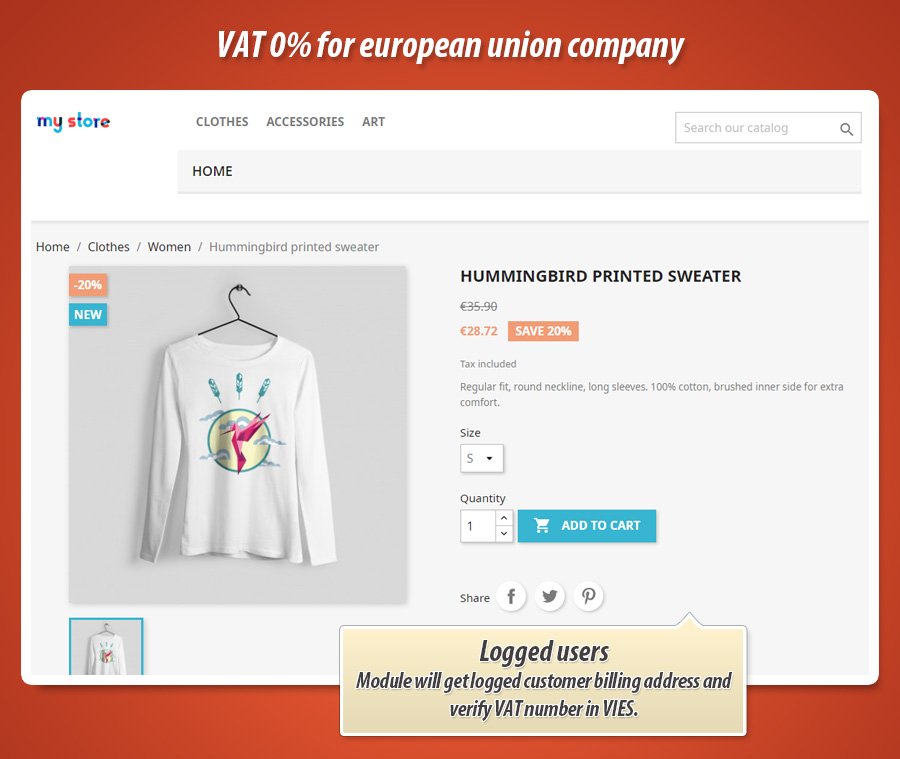

Second validation is available for logged customers. Module will check billing or invoice address (you can decide about it) address of logged customer. If there will be valid VAT number (validated with VIES) - this customer will be a subject of reverse charge VAT. So tax rates will be set to 0%. If customer will not use this VAT during checkout (as its billing invoice address) - the VAT will be switched to default one.

Please note that if customer will be logged - the only one VAT number that will be validated and used by module is a number that customer provide in their order details as a billing address.

Module Gallery

Why choose our module

Validate VAT in VIES and set 0% VAT?

Optimization and Automation

Automate VAT handling for EU B2C sales by automatically validating customer VAT numbers against the VIES database and applying 0% tax for valid business customers, streamlining compliance with EU tax regulations.

Increased Sales

Automatically applies 0% VAT for EU B2B customers with valid VAT numbers, simplifying cross-border sales and potentially boosting conversions by offering more competitive pricing for businesses.

15 years of experience

With over 15 years of PrestaShop module development experience, we understand the complexities of VAT regulations. This module leverages our deep platform knowledge to seamlessly integrate VIES validation, ensuring accurate tax calculations and compliance with evolving EU directives.

Extensive Customization

This module provides extensive customization options for VAT handling, allowing you to tailor the validation process to your specific needs. Choose between header bar, product page bar, or automatic validation for logged-in users, ensuring a seamless and compliant checkout experience for B2C and B2B customers within the EU.

Open Source Code

Gain complete control with full source code access. Modify and extend the module's functionality to perfectly match your business needs, enabling seamless integration with your PrestaShop store and other systems. No encrypted code, just pure transparency and flexibility.

License and Updates

Enjoy lifetime access to this VAT validation module, ensuring your PrestaShop store remains compliant with EU tax regulations. Validate customer VAT numbers in real-time via VIES, automatically applying 0% VAT for valid B2B transactions and simplifying reverse charge processes. Free updates are included for one year, with significant discounts available for renewal thereafter.