PrestaShop HM Revenue & Customs (HMRC) - currency exchange rates

Ensure 100% UK VAT compliance with official HMRC monthly exchange rates. This module automatizes the fetching of "Period Rates" required for accurate tax reporting and foreign currency invoicing, guaranteeing accounting consistency and eliminating manual administrative work.

Galeria

HMRC VAT Exchange Rates - UK Tax Compliant Currency Conversion

Ensure your UK-based PrestaShop store achieves full tax compliance with our HMRC exchange rate module. This essential tool automates the process of using official monthly exchange rates from HM Revenue & Customs (HMRC) for VAT accounting on foreign currency transactions. By fetching and fixing HMRC rates at the start of each month, it ensures correct VAT reporting, accounting consistency, and price stability. Features include CRON integration for automatic updates, margin management to cover exchange rate differences, and data security via direct access to official gov.uk feeds. Ideal for export invoices, corporation tax simplification and global currency support. English: Ensure your UK-based PrestaShop store achieves full tax compliance with our HMRC exchange rate module. This essential tool automates the process of using official monthly exchange rates from HM Revenue & Customs (HMRC) for VAT accounting on foreign currency transactions. By fetching and fixing HMRC rates at the start of each month, it ensures correct VAT reporting, accounting consistency, and price stability. Features include CRON integration for automatic updates, margin management to cover exchange rate differences, and data security via direct access to official gov.uk feeds. Ideal for export invoices, corporation tax simplification and global currency support.

Ensure full tax compliance for your UK-based store with a module that integrates PrestaShop with the official monthly exchange rates from HM Revenue & Customs (HMRC).

Running a business in the UK requires precision. According to HMRC guidelines, for VAT accounting on foreign currency transactions (e.g., EUR, USD), you should use "HMRC Period Rates of Exchange". These are rates set once a month that remain valid for the entire calendar month. This module automates this process, eliminating the risk of accounting errors.

How does the module ensure your Compliance?

-

"Once a Month" Automation: Instead of daily fluctuations, the module downloads the official HMRC rate at the beginning of the month and keeps it fixed, as required for VAT returns.

-

Correct VAT Reporting (Box 6): By using period rates, the net value of export sales and the VAT amount on domestic invoices are converted to GBP exactly as the tax office expects.

-

Accounting Consistency: The module ensures that the rate used on the store invoice matches the rate you will use in your VAT return, simplifying account reconciliation and audits.

-

Data Security: Rates are fetched directly from official government gov.uk feeds, guaranteeing their authenticity.

Thanks to CRON integration, the module watches the date of rate change (the first day of the month) for you. Additionally, the Margin Management feature allows you to safely add a markup to the rate to cover potential exchange rate differences arising from actual currency exchange at the bank.

Why is this module essential for a UK company?

Here are key reasons why British e-stores choose integration with HMRC:

-

VAT Compliance HMRC requires VAT amounts to be reported in Sterling (GBP). The module automatically applies the monthly rate accepted by the office, protecting you from having your returns questioned.

-

Price Stability all month long Unlike spot (market) rates, HMRC rates are fixed for the whole month. This facilitates financial planning and ensures store prices don't change overnight, which is beneficial for B2B customers.

-

Bureaucracy Automation You don't have to remember to visit the government website on the first day of every month, find the table, and manually copy the rates. CRON does it for you, saving your time and eliminating transcription errors.

-

Ideal for Export Invoices When selling to Europe (0% VAT rate), you must correctly convert the net value to GBP for "Box 6" of the VAT return. This module does this automatically in the background using the correct conversion factor.

-

Corporation Tax Simplification For consistency, many UK companies also use HMRC monthly rates to calculate Corporation Tax. Having the same rates in the store and in accounting significantly simplifies the annual settlement.

-

Global Currency Support The HMRC feed includes rates not just for the Euro and Dollar, but for hundreds of currencies. Wherever you sell, you can be sure the conversion to Pounds complies with British tax guidelines.

-

Protection against Exchange Differences With the option to add your own margin (e.g., +1.5%), you can protect yourself against situations where the official monthly rate deviates from the rate at which your bank converts payments.

-

Professional Image on Invoices When issuing an invoice in a foreign currency with UK VAT charged, you must show the tax amount in GBP. Using the official HMRC rate for this conversion is the "gold standard" of professionalism.

-

Security in case of Audit The update history in the module serves as proof that you applied the correct exchange rates at the time of the transaction, which is a key argument during potential tax inspections.

-

Free and Public Data Using official government data is free. The module generates no hidden subscription costs for data access, offering a predictable cost of store maintenance.

Module Gallery

Why choose our module

HM Revenue & Customs (HMRC) - currency exchange rates?

Optimization and Automation

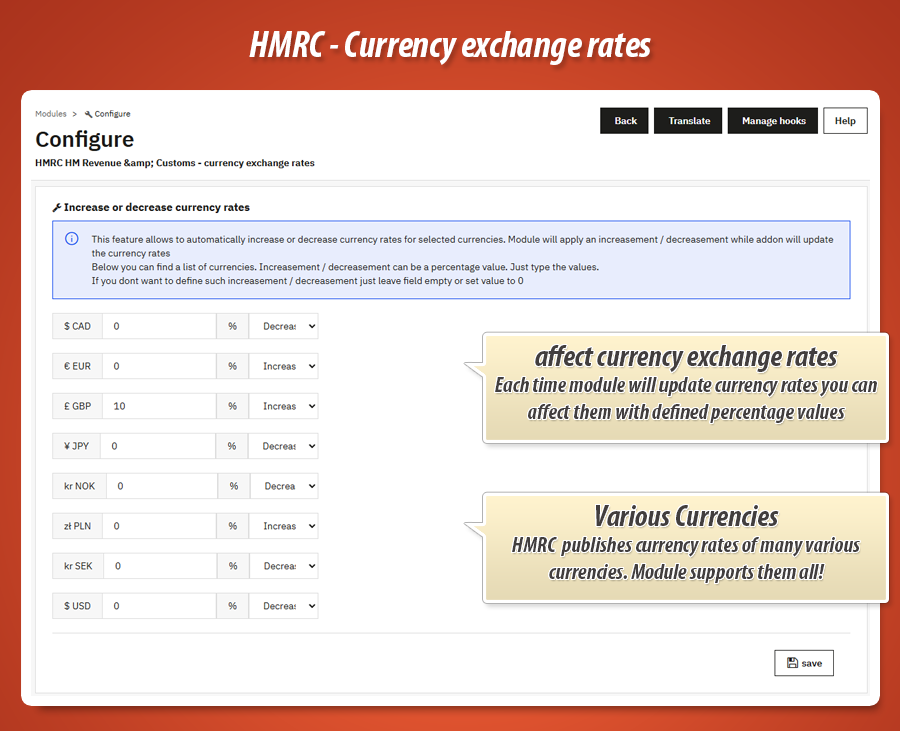

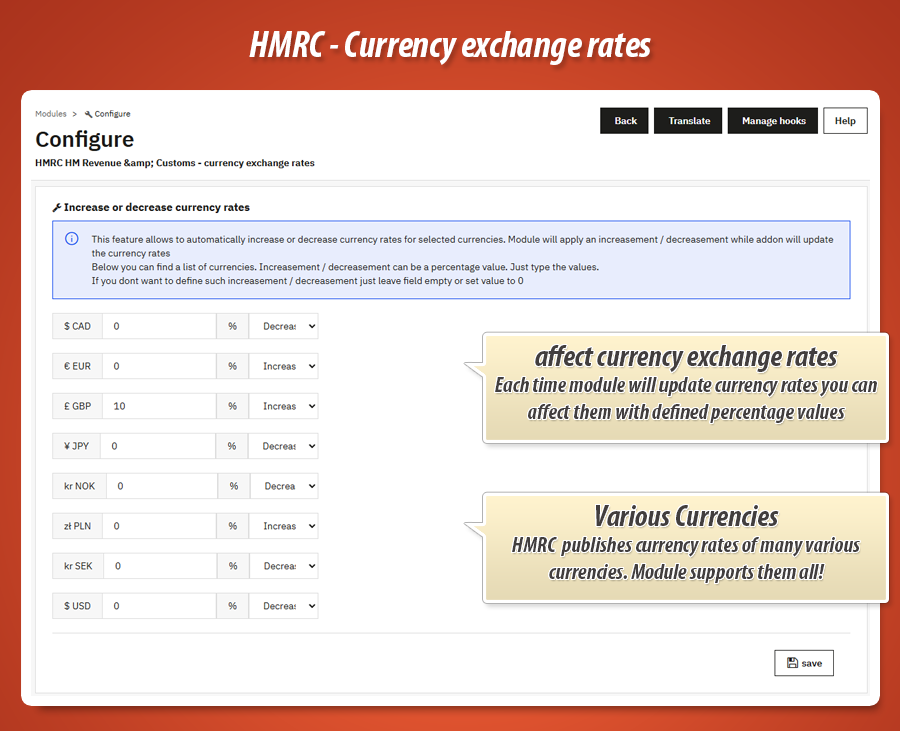

This module automates HMRC exchange rate updates, ensuring VAT compliance and price stability. CRON integration optimizes monthly rate retrieval, streamlining accounting and eliminating manual errors.

Increased Sales

Here's a property description of the module in the context of "Increased Sales": "This module enables stable pricing throughout the month, which is advantageous for B2B clients, supports seamless export invoicing, and lowers the risk of accounting errors. "

15 years of experience

Our 15 years in PrestaShop development taught us the critical need for tax accuracy. This module, born from that experience, automates official HMRC monthly exchange rates, guaranteeing UK VAT compliance and streamlining financial reporting for your e-commerce store.

Extensive Customization

The module offers configurable margin management, enabling businesses to adjust exchange rates and safeguard against currency fluctuations effectively.

Open Source Code

This module offers full access to its unencrypted source code, enabling complete customization and seamless integration with your PrestaShop store. You have the freedom to modify or extend its functionality to precisely match your unique tax compliance workflows.

License and Updates

Maintaining the module with regular updates is essential for continuous tax compliance, adapting to any changes in HMRC guidelines or official gov.uk feed structures. Your license ensures this critical integration remains functional, guaranteeing accurate, automated exchange rates for all VAT reporting, free from hidden data subscription fees.