PrestaShop Bank of Canada - currency exchange rates

This PrestaShop module automatically updates exchange rates by fetching data directly from the Bank of Canada (BOC). The plugin intelligently calculates all cross-rates based on your store's default currency and allows you to add your own percentage margin. Thanks to CRON integration, the process is 100% maintenance-free.

Galeria

PrestaShop Bank of Canada CAD Exchange Rates Auto-Update & Margin

This PrestaShop module fully automates currency exchange rate updates using official data from the Bank of Canada (BOC). It connects directly to the BOC's "Valet" API to fetch the latest daily rates, intelligently processing them to identify the latest available business day. The module precisely calculates cross-rates for all active store currencies, updating them in your PrestaShop panel. Thanks to CRON integration, the entire process is 100% maintenance-free, eliminating manual intervention. Users can also define individual percentage margins for each currency, providing full control over pricing strategy and hedging against fluctuations. This ensures reliable, precise, and autonomous currency management for your store.

This PrestaShop module fully automates the currency exchange rate update process in your store, using official public data from the Bank of Canada (BOC).

The module connects directly to the "Valet" API provided by the Bank of Canada to fetch the latest daily exchange rates. The default base currency for all calculations is the Canadian Dollar (CAD).

After fetching the data, the module intelligently processes the rates:

-

It identifies the latest available business day with data (automatically skipping weekends and bank holidays).

-

It builds an efficient "map" of all available exchange rates.

-

It precisely calculates cross-rates for all active currencies in your store, relative to your default currency (e.g., EUR, USD).

-

It updates these rates in the PrestaShop panel.

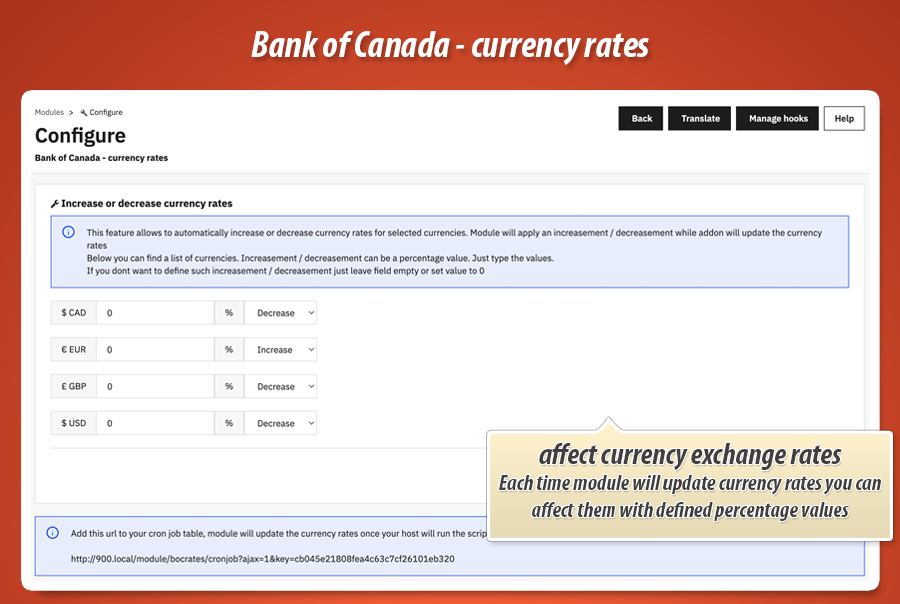

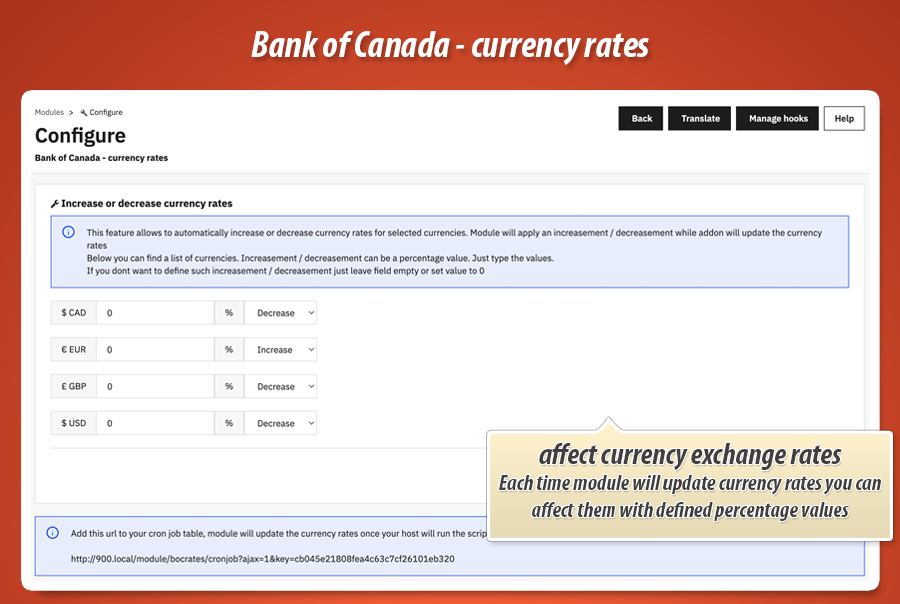

Thanks to integration with CRON tasks, the entire process can be 100% maintenance-free. The module also allows you to define an individual percentage margin (positive or negative) for each currency, giving you full control over the final prices.

Key Advantages of the Module

Here are 10 key advantages of using this module in your PrestaShop store. Implementing this module in the PrestaShop environment comes with the following key benefits:

-

Full Process Autonomy The module is designed for tight integration with the server's CRON task scheduler. A one-time configuration of a recurring task (e.g., on a daily frequency) initiates a fully autonomous process of fetching and updating rates, eliminating the need for any manual operator intervention.

-

Data Reliability Based on an Official Source The software relies exclusively on the Bank of Canada's API. This institution's status as one of the world's leading central banks guarantees the official nature, high reliability, and precise reflection of current market realities in the retrieved data.

-

Advanced Margin Level Management The module implements functionality that allows defining a custom percentage margin, specific to each currency. The ability to apply both a positive margin (e.g., +1.5%) and a negative one (e.g., -0.5%) provides high flexibility in shaping pricing policy and serves as a tool to hedge against currency fluctuations.

-

Precision of Cross-Rate Calculations Regardless of the store's configured default currency (e.g., EUR), the module correctly uses CAD as the base currency to calculate all mutual relationships. The implemented mathematical algorithm guarantees that currency rates in the store (e.g., EUR to SEK or EUR to NOK) are calculated with high precision.

-

Resilience to Data Discontinuity The module features advanced operational logic. If the CRON task is triggered on a non-working day, a bank holiday, or before the BOC publishes data, the software will automatically analyze the observation history to identify the last available, complete dataset. This mechanism ensures operational continuity and eliminates the risk of unimported rates.

-

High Operational Performance and Resource Optimization The processing of data retrieved from the API is designed with performance in mind. The module first constructs an optimized, internal rate-mapping structure before initiating the update loop. This process flow is optimized to minimize the load on the server and database.

-

Transparent Process Reporting Each execution of the module initiated by a CRON task generates a detailed and readable report. This report includes information about the default currency, the calculated rates, and any currencies skipped during the process (e.g., due to their absence in the BOC data source). This significantly facilitates monitoring the operation's progress and any potential diagnostics.

-

Elimination of Additional Operational Costs The use of the Bank of Canada API is entirely free of charge. Consequently, the module does not require any subscriptions or access keys, which eliminates the risk of any additional or hidden licensing fees related to its operation.

-

Operational Stability and Exception Handling If a currency is active in the store that is not supported by the Bank of Canada data source (e.g., PLN), the module will not interrupt its operation or generate a critical error. The software will note the omission of that currency in the report (log) and safely continue the update process for the remaining, supported currencies.

-

Optimization for North American Markets If the business conducts settlements in Canadian Dollars (CAD) or its main operational market is Canada, this module is the optimal solution. It provides access to exchange rates directly from that country's central bank, which is crucial for maintaining full financial consistency.

Module Gallery

Why choose our module

Bank of Canada - currency exchange rates?

Optimization and Automation

This module automates currency exchange rate updates from the Bank of Canada, leveraging CRON for a 100% maintenance-free process. It intelligently processes rates, calculates cross-rates, and optimizes store efficiency by eliminating manual intervention and ensuring data continuity.

Increased Sales

Automated, precise currency updates and flexible margin management empower you to offer competitive pricing globally. Customers enjoy accurate local currency displays, fostering trust and a smoother checkout, ultimately driving higher conversion rates and increased sales.

15 years of experience

Leveraging 15 years of PrestaShop expertise, this module ensures unparalleled currency rate automation. Its reliable BOC data integration, precise cross-rate calculations, and robust error handling reflect our deep understanding of e-commerce needs and system stability, honed over a decade and a half.

Extensive Customization

This module provides extensive customization by allowing you to define individual percentage margins (positive or negative) for each currency. This advanced margin management offers full control over your pricing policy, perfectly adapting to your store's financial strategy.

Open Source Code

Providing complete access to its source code, the module allows for advanced custom development and seamless integration with your store's unique requirements. This transparency empowers you to modify its currency processing logic, margin adjustments, or reporting features directly, offering ultimate flexibility.

License and Updates

The module ensures no additional operational costs as the Bank of Canada API is entirely free. It requires no subscriptions or access keys, eliminating hidden licensing fees related to data access and keeping your exchange rate updates economical.